Verify Checks Online

Check Verification | Verify Banks Accounts and Balances

Verify all checks before they're resubmitted to your bank or processor. Remote Deposit Capture Use our Remote Deposit Capture software to scan physical checks conviniently at your home or office. Combine your transactions with virtual checks to easily submit recurring transactions and emboss customer signatures. Credit Card Gateway

http://checkverification.com/

How to Verify a Check Before Depositing | SoFi

Here are a few ways to identify if a check is fake or valid. • Ensure a legitimate bank issues the check. Although a valid bank might issue some fake checks, a sure giveaway of a fake check is that a fake bank name is on it. To locate an FDIC insured bank in the US, consumers can use the FDIC BankFind . • Call the bank the check is from.

https://www.sofi.com/learn/content/how-to-verify-a-check/

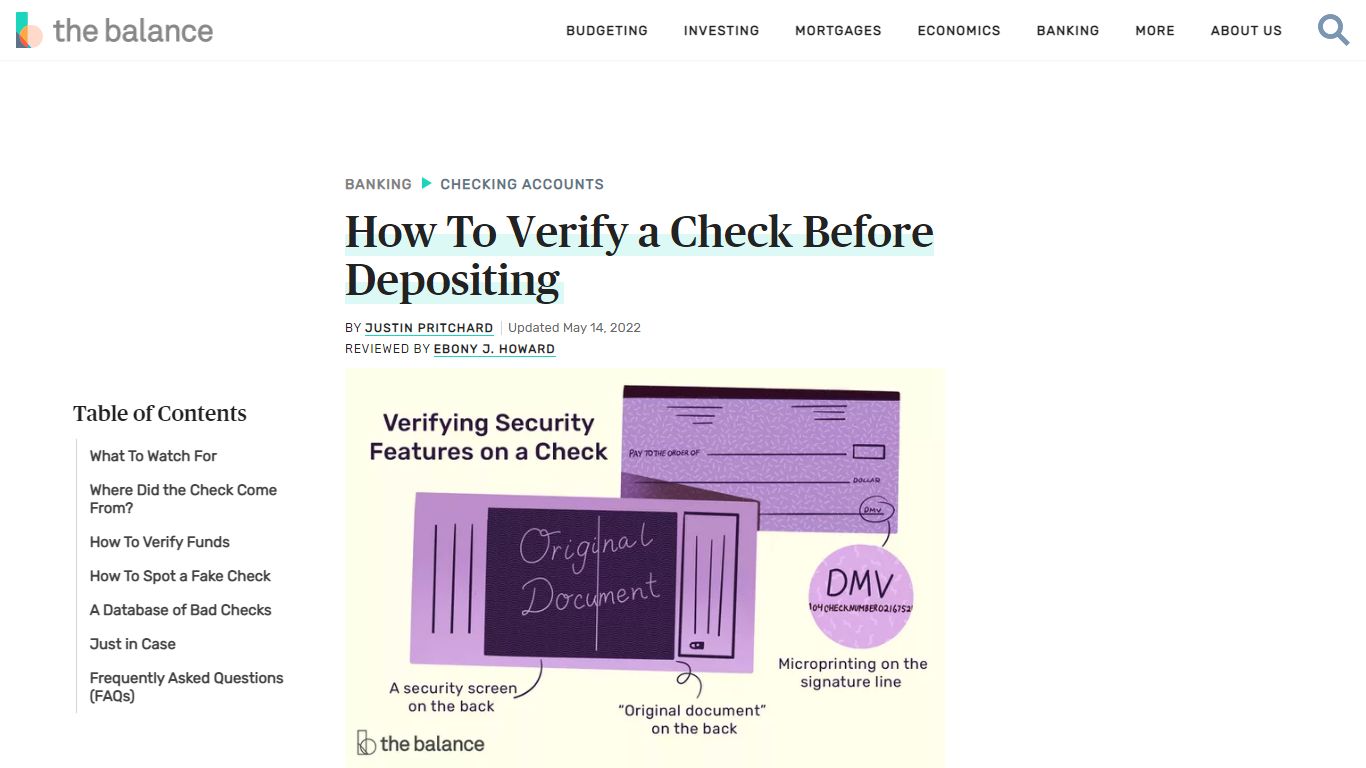

How To Verify a Check Before Depositing - The Balance

To do so, contact the bank that the check is drawn on and ask to verify funds. Some banks, in the interest of privacy, will only tell you whether or not the account is valid, or they will not provide any information at all. 2 Others may be able to tell you if there is currently enough money in the account to cover the check.

https://www.thebalance.com/how-to-check-a-check-315428

Free Online Check Verification!?!? - CrossCheck

Free online check verification can be yours in minutes! There's no cost, no hassle, no service agreement and you'll be able to tell instantly whether there's money in the check writer's account to cover the check they just wrote you.

https://www.cross-check.com/blog/bid/196065/Free-Online-Check-Verification

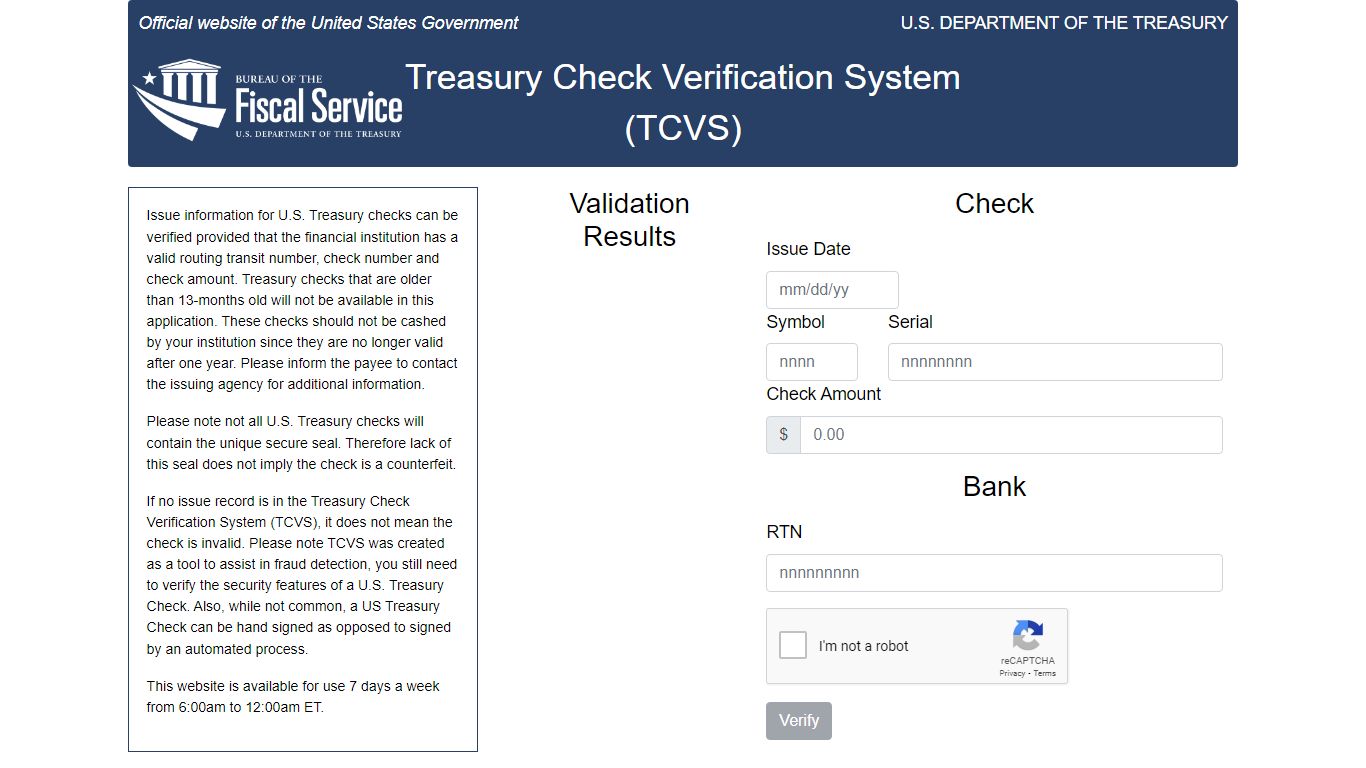

Treasury Check Verification System - TCVS

Treasury Check Verification System (TCVS) Issue information for U.S. Treasury checks can be verified provided that the financial institution has a valid routing transit number, check number and check amount. Treasury checks that are older than 13-months old will not be available in this application.

https://tcvs.fiscal.treasury.gov/

Check Verification | Vericheck, Inc

Empowering you to make an educated decision on which customer checks you will accept VeriCheck’s Verification program allows you (the merchant) to track a combination of variables and provides numerous ways to help minimize and prevent your exposure to the intentional bad check writer. Here’s how it works: For both POS and Online Checks (Internet […]

https://www.vericheck.com/check-verification/

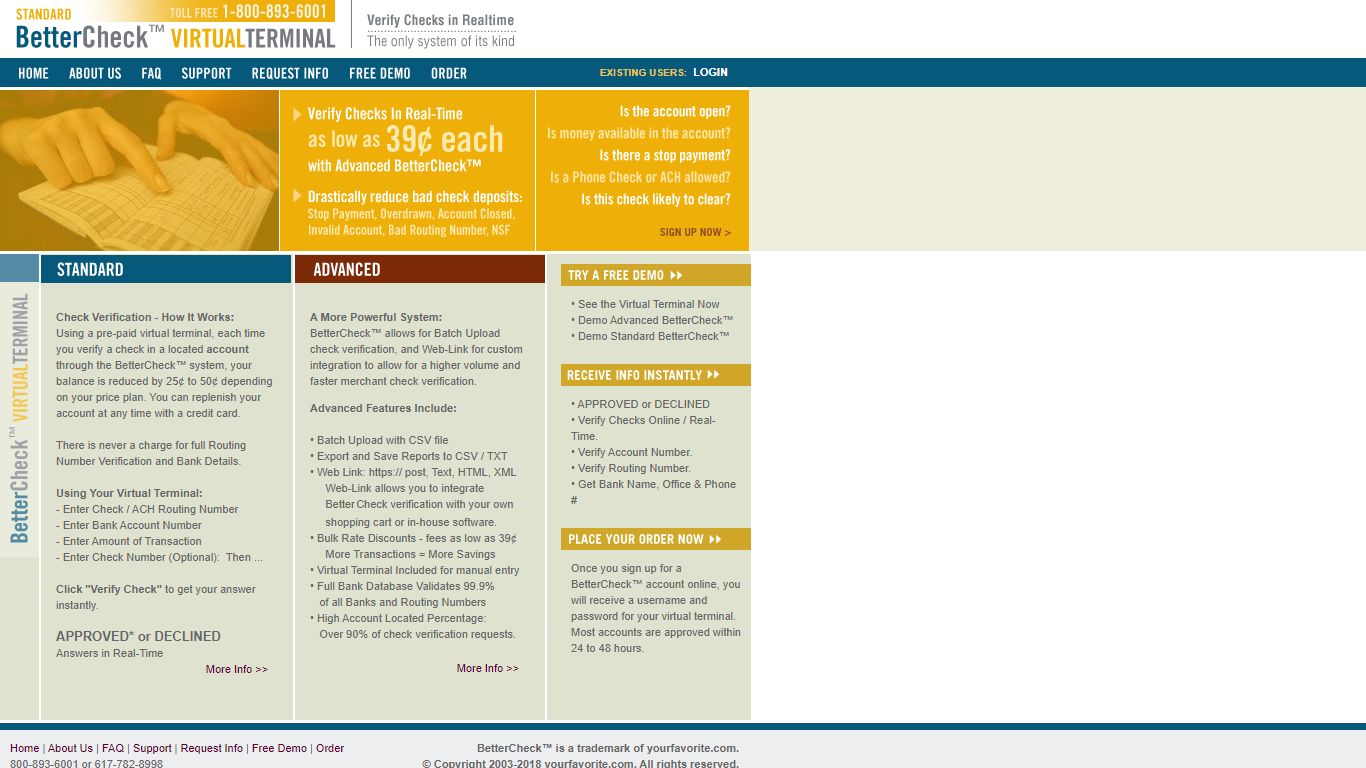

Check Verification. Verify Checks with BetterCheck Virtual Terminal.

Check Verification - How It Works: Using a pre-paid virtual terminal, each time you verify a check in a located account through the BetterCheck™ system, your balance is reduced by 25¢ to 50¢ depending on your price plan. You can replenish your account at any time with a credit card.

https://bettercheck.com/

Electronic Check Verification Services | Deluxe eChecks

It’s easier and faster to create and send payments with eChecks and Print+Mail Step 1 Create an account and link bank account to the platform. Step 2 Enter payment details, remittance data and attachments directly into the platform, then upload a file, or, if using an eCheck, use the QuickBooks® connection.

https://www.deluxe.com/payments/digital/echecks/verify/Deluxe Payment Exchange (DPX)

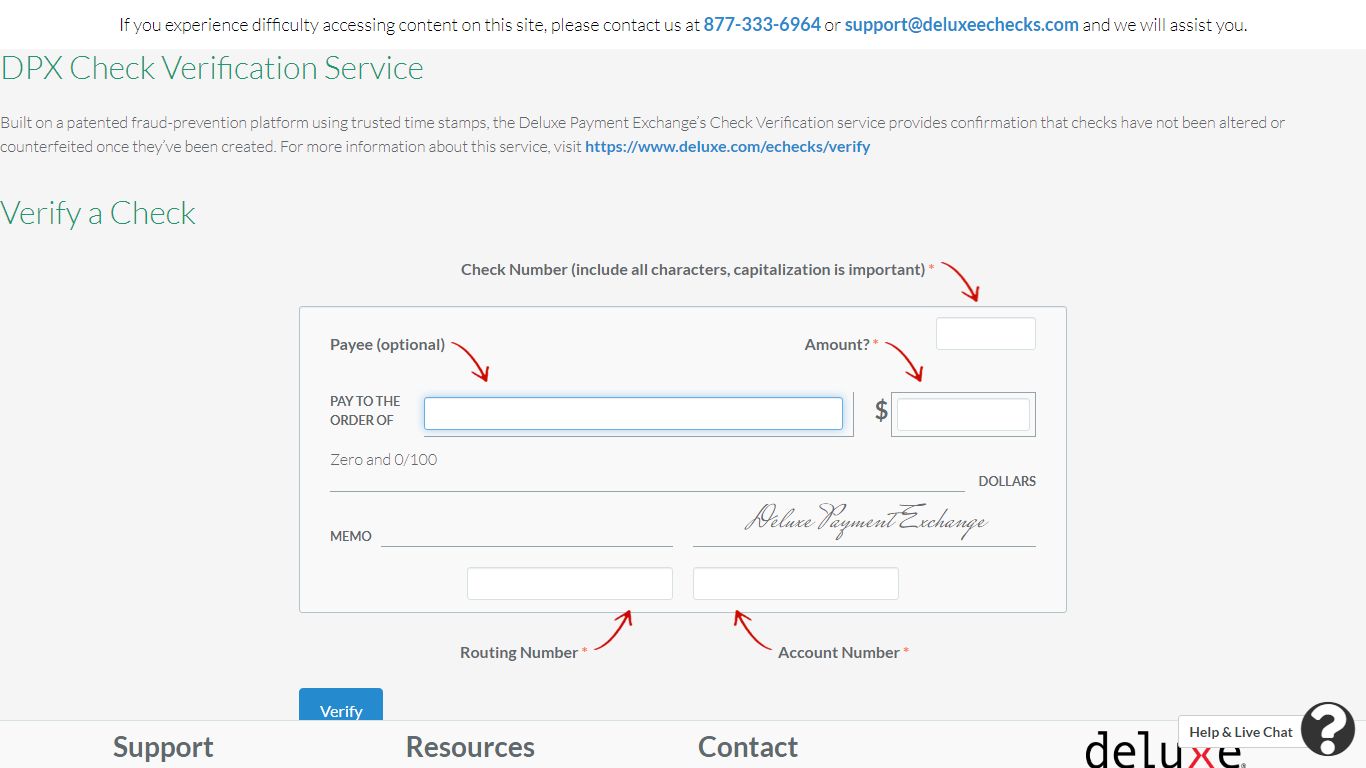

DPX Check Verification Service Built on a patented fraud-prevention platform using trusted time stamps, the Deluxe Payment Exchange’s Check Verification service provides confirmation that checks have not been altered or counterfeited once they’ve been created.

https://my.echecks.com/checks/verify

Accept, Send, & Verify Checks Online with Seamless Chex

eCheck Verification Instantly bank account balance confirmation. Reduce fraud and bank NSF fees. Learn More Check Processing Accept eChecks and we'll initiate deposits directly into your bank account Learn More Accept Credit Cards Start accepting credit and debit cards online and in store. Learn More

https://www.seamlesschex.com/

Self Check - E-Verify

Self Check lets you confirm that your employment eligibility information is in order by checking it against the same databases E-Verify uses when employers enter a case. If Self Check finds a data-mismatch, you can receive instructions to correct your records with the appropriate federal agency.

https://www.e-verify.gov/mye-verify/self-check